In December 2017 the 115th Congress of the United States passed a major act dealing with taxes. One of the changes in the Tax Code pertained to ESA or Educational Savings Accounts. Most parents and grandparents are probably familiar with ESAs as a means of saving for their children and grandchildren's college educations. Congress has expanded Section 529 ESAs to include K-12 education expenses as well as college expenses.

First, a bit of history. The educational savings accounts known as Section 529 plans were created by the Small Business Job Protection Act Of 1996. The section of this act which pertains to educational savings accounts is entitled PART VIII—QUALIFIED STATE TUITION PROGRAMS. The text begins on page 141. This is worth reading so that you can discuss the topic with your financial advisor when you set up your 529 plan.

Changes to the Tax Code

On Friday, December 22, 2017 President Donald Trump signed An Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018 While the Act has effects on a wide range of tax situations, the specific text pertaining to K-12 educational expenses can be found on page 74. Here is the relevant paragraph:

‘‘(7) TREATMENT OF ELEMENTARY AND SECONDARY TUITION.—Any reference in this subsection to the term ‘qualified higher education expense’ shall include a reference to expenses for tuition in connection with enrollment or attendance at an elementary or secondary public, private, or religious school.’’.

Note that the Act broadens Section 529 educational savings accounts to include elementary or secondary public, private, or religious schools. Some of the early media reports implied that this Act favored only private K-12 schools. That is inaccurate, as the Act clearly states that all K-12 schools, public, as well as private, are covered by the law.

For this article, we shall review the Act insofar as it concerns the tax-advantaged savings plan known as the 529 plan.

Definition of 529 Plans

The United States Securities and Exchange Commission defines 529 Plans as follows:

"A 529 plan is a tax-advantaged savings plan designed to encourage saving for future college costs. 529 plans, legally known as “qualified tuition plans,” are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code."

The IRS offers a detailed explanation of 529 plans which is worth reading. After you have read about 529 plans, I am sure you will have questions about them similar to the ones which I have listed below. Be sure to discuss get answers to these questions from your financial visor.

- How much can you contribute?

- Who may contribute?

- What form can the contributions take?

- Is it better to fund my 529 plan with a lump sum or invest gradually over time?

- Which withdrawals are qualified?

- Which withdrawals are non-qualified?

What the recently enacted changes to the tax code did to 529 plans is to add K-12 schools, private, public, or religious. 529 plans now permit you to save for both college educations and K-12 school educations.

An Overview of How 529 Plans Work

When you actually examine 529 plans as a whole and more specifically the 529 plan which operates in your state, you will discover as I did that you can save any amount of money, no matter how small. While maximums for the individual plans are set forth by each state, the contributions are modest. Zero to $25 minimum contributions are the norm. What I like about that is that a family of modest means can make small but regular contributions over the course of several years.

Depending on the investments which you select, your initial contributions will grow, thanks to compounding and savvy investment management. Several investment managers such as Fidelity and Vanguard offer 529 plans.

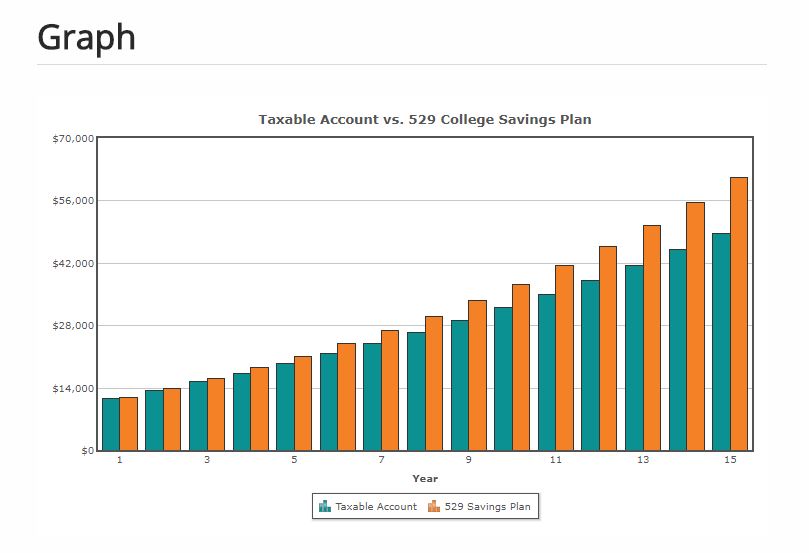

CalcXML has a calculator which illustrates how a 529 plan might grow your investment versus a taxable savings account. My assumptions in this example were an initial investment of $10,000 and an annual investment of $1,000. How much you decide to save for your child's private school expenses is a decision which you should make after discussion with your financial adviser.

Take time to review how a 529 plan managed by an investment manager can help you save for K-12 education expenses such as tuition, books, room and board, computers, and so on.

Funding Considerations

“The most effective way to leverage the new benefits of the 529 plan is to 'superfund' the plan, meaning you invest an initial principal amount that will grow to cover future expenses without the need to invest more dollars in the future. Therefore, you take full advantage of the compounding effect.

Yes, You Really Can Pay for Private School With 529 Plans Now by New York Times writer Ron Lieber, offers a useful illustration of a family investing $200,000 in a 529 up front. As financial advisor Zachary A. Conway, financial advisor and director of Conway Wealth Group, points out, by investing up front, the family in this New York Times story could not only withdrawal $10k/year before college but also would have a significant sum to pay for full college expenses when that time came. In addition, the couple would save tens of thousands of dollars in taxes over that time frame.

Withdrawal Considerations

Conway also offers the following advice: "A few dynamics to consider, but there’s no silver bullet in terms of ratios. While it’s great on the surface that you can use the funds for K-12 educational expenses, needing to withdraw money each year cuts into the principal. It also negates the compounding effect as previously described. Withdrawals from a 529 account typically begin ten to 15 years after you established the account. As well, you usually would make withdrawals over the more limited time-frame of 4 years. These time considerations allow for your principal to grow over a longer time."

"Making yearly withdrawals exposes you to shorter-term volatility risk. If the market is down the year of your withdrawal, you may be banking a loss in your account. The biggest benefit of any investment account is its time horizon. The longer you let the money grow, the more you will theoretically have in the future. If you plan to make the yearly withdrawals, you need to pay closer attention to how the funds are allocated. In other words, you shouldn’t be taking on as much risk as someone who plans to let the money sit for 12 years. Say a couple puts $10,000 in the plan the year before their child goes to Kindergarten and decides to invest the funds in a “growth” fund that’s heavily allocated in stocks. Next year, if the market suddenly loses 20% and the couple needs those funds for school, they would have been better off keeping their money in cash."

Some 529 plans are state-operated.

It is important to understand that many 529 plans are operated by individual states, as opposed to being operated by the federal government. Contributions to these plans are deductible from the appropriate state taxes, not your federal taxes. You can find a list of states which have set up 529 plans here.

There are four basic types of 529 plans.

- Broker Sold Savings Programs

- Direct Sold Savings Programs

- Prepaid Contract/Guaranteed Savings

Broker Sold Savings Programs are 529 plans which are sold by investment brokers, financial advisors, banks, and so on.

Direct Sold Savings Programs are 529 plans which are sold with no middleman directly by the state.

A Prepaid Contract allows you to prepay your child's future education at today's prices. Note: the number of states offering Prepaid Contract 529 plans are dropping. As Kathryn Flynn explains in SavingForCollege.com:

"Most of what we hear and read about 529 plans is focused on the more popular "savings" plans, but for some families, there's another effective way to prepare for college costs. As the name implies, prepaid tuition plans allow you to pre-pay future college costs today. There are currently 18 state-sponsored and one institution-sponsored prepaid plan (Private College 529 Plan), but only 11 are currently accepting new applicants, and nine of these have residency requirements.

Of the 11 available plans, nine are "contract" plans, which allow you to pay for a certain number of semesters of college tuition, and two are "unit" plans, which let you buy fractional units that are redeemable in the future based on average tuition rates at a target group of schools, typically one percent of one year of tuition. In other words, contract plans work like a futures contract and unit plans operate like a tuition index fund."

State Tax Breaks

In SavingForCollege.com, Kathryn Flynn reviews the issue of state tax breaks for 529 plans. Missouri, Utah, and Delaware have already made withdrawals from 529 plans to pay for K-12 school expenses tax-free. Several other states' proposals to make these withdrawals tax-free are pending. Withdrawals from 529 plans for K-12 educational expenses are tax-free at the federal level. However, individual states have to approve tax breaks. Just because withdrawals are tax-free at the federal level doesn't mean that they will be tax-free in your state.

The other benefit is that your 529 plan contributions are deductible from income taxes in some states which have taxes on your income. This is where things get a bit complicated. Why? Because you want to compare the cost of managing your 529 plan investments with tax benefits available. Ask your financial advisor to help you find the best solution for your needs and requirements.

Note: most states are in the process of updating their 529 plan regulations so as to conform with the new federal law. Consequently, the information which you see on some state websites may still refer to 529 plans for college, as opposed to the new, inclusive K-12 educational expenses version of the 529 plans.

Coverdell Educational Savings Accounts

Another educational savings option is available for both K-12 and post-secondary education expenses. That is the Coverdell Educational Savings Account. As you plan your K-12 educational savings accounts, you will most likely also be thinking about your children's educations after high school. Discuss this particular ESA with your financial adviser to see if it is a viable option for your specific financial situation. The main drawback to the Coverdell ESA is that your annual contributions are limited to $2,000. They are also only available to families with income below a specified level.

In US News, Jeff Brown explains the ins and outs of Coverdell Educational Savings Accounts. These ESAs have been around since 1998 but have largely escaped the notice of the general public. You should include them in your discussions about paying for your children's college educations.

The Bottomline

If you have children in private school or plan to have children in private school, be sure to investigate 529 plans thoroughly. Even though you may think that you understand all the rules and regulations, ask your financial advisor for advice and guidance. It is always better to be safe than sorry when it comes to appreciating the implications of the recently passed changes to the tax code and how they affect 529 plans. Ask the legal and financial experts. Then follow their advice.

Editor's note: I am most grateful to Zachary A. Conway of Conway Wealth Group for his expert advice and input for this article. Conway Wealth Group is a New Jersey-based private wealth advisory and financial planning firm serving high-net-worth families. In tandem with coordinated financial planning and investment management, Conway Wealth Group guides clients toward Aligning Life & Wealth®. ~Rob Kennedy

Disclaimer: The information in this article is strictly for informational purposes only, and not for the purpose of providing legal or financial advice. You should contact your attorney and financial adviser to obtain advice with respect to any particular issue or problem.

Questions? Contact us on Twitter. @privateschoolreview